W2 and 1099 software provider, Halfpricesoft.com, just released a new YouTube video “How to Print a W-2 Form†for small business owners and HR managers who are facing the Jan 31  tax forms mailing deadline. The Video teaches users how to prepare and print W-2 forms themselves step by step with ezW2 software.  User can view this video at https://www.youtube.com/watch?v=_ovH2ug5XkM

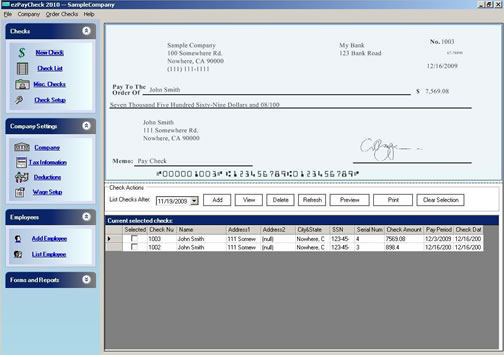

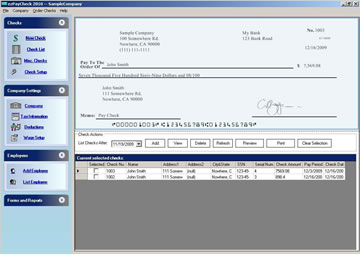

Founded in 2003, Halfpricesoft.com has established itself as a leader in meeting the software needs of small businesses around the world with its payroll software, employee time tracking software, check printing software, w2 software and 1099 software. It continues to grow with its philosophy that small business owners need affordable, user friendly, super simple, and totally risk-free software.

“Small business owners shouldn’t be spending hour after hour setting up and learning to use payroll tax software,” said Halfpricesoft.com founder Dr. Ge. “We designed ezW2 to be powerful, yet simple, so anyone can use it, and ezW2 2011 is the most easy-to-use version to date.”

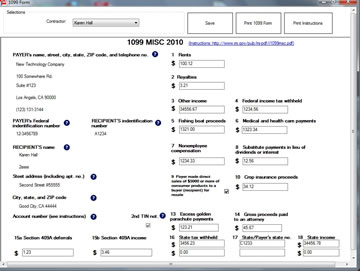

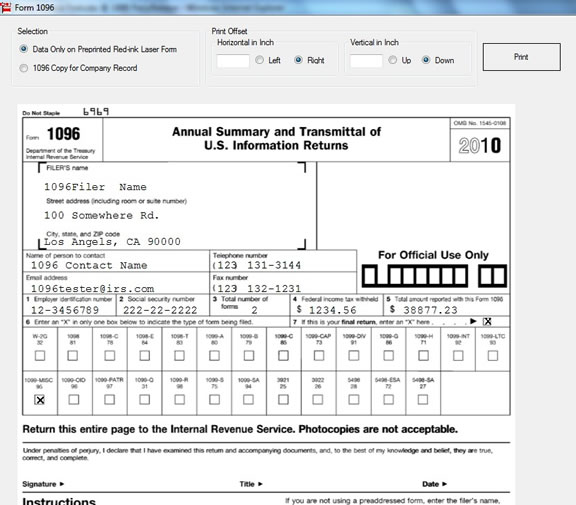

ezW2 software supports forms W2, W3, 1099-misc and 1096. It can print the SSA-approved laser substitute forms of W-2 Copy A and W-3 on white paper. So with ezW2, users will not need to order the expensive red-forms for W-2 return.

Available from just $39 per installation, ezW2 software has remained at that affordable price since its initial release in 2006. Equipped with an intuitive graphical user interface, the W-2 and 1099-misc printing software is designed to be easy to use even for people without an accounting background or with little computer experience.

EzW2 is compatible with Windows 7 system, 32-bit or 64-bit. It can run on Windows XP, Me, 2003, Vista system or MAC machines installed with Virtual Machine or Parallel . Customers can download this W2 and 1099 application online at http://www.halfpricesoft.com/w2-software-free-download.asp and sample the software without charge or obligation, allowing them to thoroughly test drive ezW2 before purchasing.

For more information about ezW2 and Halfpricesoft.com, please check this 1099 & w2 software at http://www.halfpricesoft.com/w2_software.asp.

Via EPR Network

More Accounting press releases