Cost is rising, overseas competition is encroaching, and margin is being cut. In this challenging environment, how to increase business efficiency is critical for any company. The new edition of ezPaycheck payroll software can help small businesses deal with the payroll taxes processing in a stress-free way and enables companies to focus on core activities.

The latest edition is with the new Year 2011 Form 941. Other new features of ezPaycheck 2011 payroll application include Customizable Payroll Reporting Feature, Auto-fill Paycheck Data Feature, Customizable Tax and Deduction Features, Employee List Export Feature, Income tax rate updates and Tax form updates, which make the 2011 edition more powerful and flexible than ever.

Halfpricesoft is a leading payroll tax software solution provider for small businesses, non-profits and accountants. ezPaycheck software is designed to help keep small companies payroll operations running smoothly and efficiently. The user-friendly design make is ideal for use by non-accountants with minimal computer skills. However, even accountants like it because it is so flexible and supports unlimited accounts with one flat rate.

“Small business owners have enough to do without having to manually calculate wages,†said Dr. Ge, founder of Halfpricesoft.com. “We created ezPaycheck to free up time for more important tasks and simplify the lives of business. The tedious chore of calculating payroll taxes no longer needs to be a concern for small business owners.â€

ezPaycheck reduces payroll costs

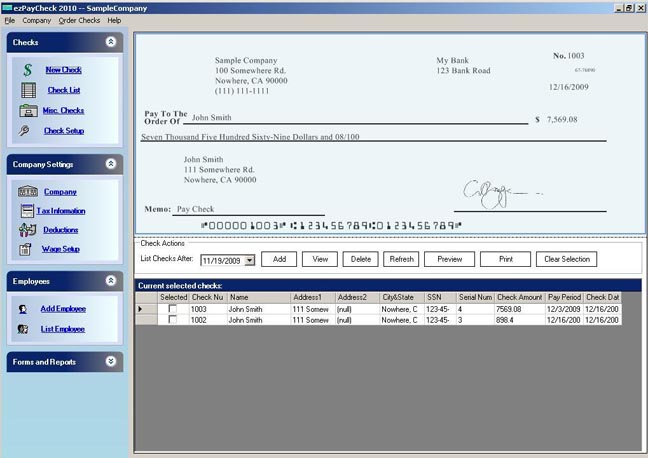

Priced at just $89 per installation, ezPaycheck is the most Affordable and flexible payroll accounting software in the industry. And ezPaycheck can supports multiple companies and unlimited checks with no extra cost.

ezPaycheck saves time for business owners

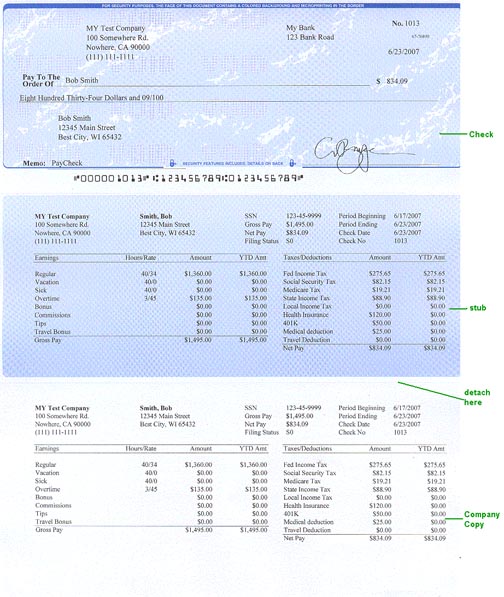

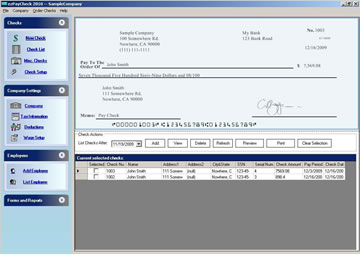

Once employee information is set up, including pay rates, dedutions and tax options, ezPaycheck automatically calculates payroll taxes. And ezPaycheck also generate the W-2 forms based on payroll data.

ezPaycheck is easy to use, with no learning curve to get started

ezPaycheck is easy to use, with no learning curve to get started

No accounting skills or computer background are required to use ezPaycheck. The software’s graphical interface is highly intuitive and guides users step-by-step through all processes.

Additional features supported by ezPaycheck include:

– Capability for adding local tax rates

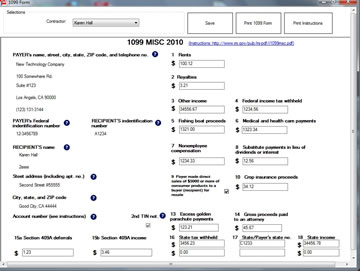

– Automatically calculate tips, commissions, federal withholding tax, Social Security, Medicare tax, employer unemployment taxes, and other pre-tax and post-tax deductions

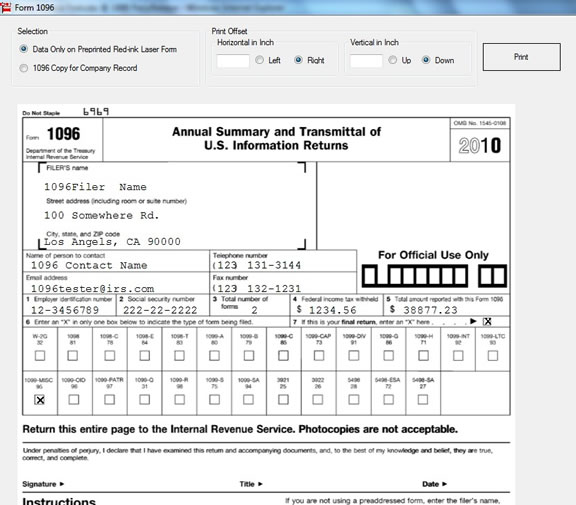

– Form 940 and Form 941 printing

– Supports forms W-2 and W-3

– Calculate and print daily, weekly, biweekly, semimonthly and monthly payroll periods

– Use check-in-middle, check-on-top, or check-at-bottom check stock formats

– Able to print MICR numbers on blank check stock to save on pre-printed checks

Small Business Owners can try ezPaycheck 2011 payroll tax solution without cost or obligation

ezPaycheck 2011 can be downloaded at http://www.halfpricesoft.com/payroll_software_download.asp for free and tried for up to 30 days to ensure the software meets the customer’s needs before purchasing. The free download includes all features of ezPaycheck 2011, except check printing. For full, unlimited use customers must purchase a license key.

To make sampling ezPaycheck 2011 even easier, the free download includes a sample database. Customers do not have to waste time entering employee data before sampling the software’s many features.

User can purchase ezPaycheck 2011 software online at http://www.halfpricesoft.com/index.asp, and receive the license key immediately after the transaction is done.

Or check the video ezPaycheck Made Your Payroll an Easy Job

http://www.youtube.com/watch?v=JISurtSXoZ0

Via EPR Network

More Accounting press releases

* Exports Payroll Data to QuickBooks software.

* Exports Payroll Data to QuickBooks software.