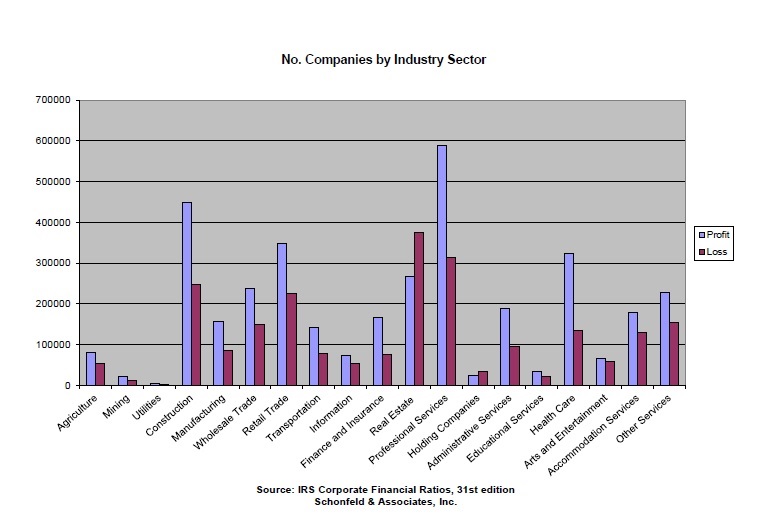

CHENNAI, 2022-Oct-31 — /EPR ACCOUNTING NEWS/ — In the past, businesses kept track of their income and expenses with pen and paper. Today, there are many software programs that can do this for you. This is called “billing software.â€Â Billing software is a type of accounting software that companies use to manage customer invoices and payments. The software can automate and streamline the billing process, saving businesses time and money. It can also help businesses keep track of their finances and customers.

CHENNAI, 2022-Oct-31 — /EPR ACCOUNTING NEWS/ — In the past, businesses kept track of their income and expenses with pen and paper. Today, there are many software programs that can do this for you. This is called “billing software.â€Â Billing software is a type of accounting software that companies use to manage customer invoices and payments. The software can automate and streamline the billing process, saving businesses time and money. It can also help businesses keep track of their finances and customers.

It will be useful to keep track of your customers, invoices, and payments. It can also help you manage your inventory and create reports. There are many different types of billing software available, so businesses should choose the one that best fits their needs.

What is Billing Software?

With the technological advances we have today, and it is no wonder that more and more businesses are using online billing software. This type of software can save business time and money. With online billing, businesses can send invoices and receive payments electronically. This is a very convenient way to do Business, and it is also eco-friendly. With online billing software, businesses can automate their invoicing and payments. This can free up a lot of time for businesses to focus on other areas of their Business. Online billing software can also help businesses keep track of their spending and income, and it can help them manage their cash flow better. This is a valuable tool for any business owner.

Need for Billing Software:

The way businesses handle their finances has changed drastically in recent years. With the advent of technology, businesses have had to find ways to keep up with the times. One such way is by using online billing software. This type of software allows businesses to manage their finances in a more efficient and effective manner. It also eliminates the need for paper bills and statements. Online billing software is a necessity for any business that wants to stay ahead of the curve. It allows businesses to keep track of their finances and customers. It is important to choose the right billing software for your Business. The right billing software can save you time and money. There are many different types of billing software on the market. You need to find one that fits your specific business needs. Here we give the suggestions with the best of all in the market. The ECBill is the best online billing software in Chennai, and it fits any kind of Business. It is extremely user-friendly and easy to navigate. It has a wide range of features that are designed to make billing simple and efficient. ECBill integrates with a number of popular accounting software programs. Their pricing is very affordable, and they offer excellent customer support.

Why is ECBill the best Online Billing Software?

ECBill is the best online billing software for several reasons. Here we listed out few:

- It is extremely user-friendly and easy to navigate.

- It offers a wide range of features and options, which makes it ideal for businesses of all sizes.

- ECBill is highly customizable, so you can tailor it to your specific business needs.

- It integrates seamlessly with a number of popular accounting software programs, making it easy to keep track of your finances in one place.

- ECBill offers a variety of payment options, so you can choose the one that best suits your needs.

- It offers excellent customer support.

- ECBill is very affordable and offers a free trial period.

- It increases efficiency by automating the billing process.

- It saves time by eliminating the need to generate invoices manually.

How does ECBill online Billing software assist your Business?

Billing software is a crucial part of running a business. Almost every Business, whether small or large, requires some sort of billing software to manage its invoices and payments. It allows you to keep track of your finances, invoices, and customers. There are many benefits to choosing billing software for your Business.

The software can save you time and money by automating your billing process. With all of your financial information in one place, you can easily generate invoices and track payments. This can save you hours each month. It can also help you to keep track of your customers’ payments and invoices. It can help you to manage your inventory and to create reports that can help you track your Business’s financial health. There are many different types of billing software available, so it is important to choose one that is right for your Business. It’s important to have a billing system that is efficient and effective. Here we give the best online billing software, “ECBillâ€, which suits all types of Business. You can automate many of the tasks associated with billing, such as creating invoices and sending payments. This can free up your time so that you can focus on other aspects of your Business. It can help you manage your finances more effectively and keep track of your spending.

This Press Release is distributed by a Digital Agency from Chennai.

Via EPR Network

More Accounting press releases